Missouri Welcomes International Companies

- February 21, 2023

Missouri is an extremely pro-business state, with companies from across the globe operating in it. Foreign businesses are drawn to Missouri due to its low tax rates, affordable cost of doing business, and skilled labor. The state offers a 4% corporate income tax rate, which is one of the lowest in the U.S. Additionally, the state has some of the most reasonable utility costs for businesses. According to the Energy Information Administration in 2021, Missouri is 20% less expensive for U.S. Commercial electricity cost rates.

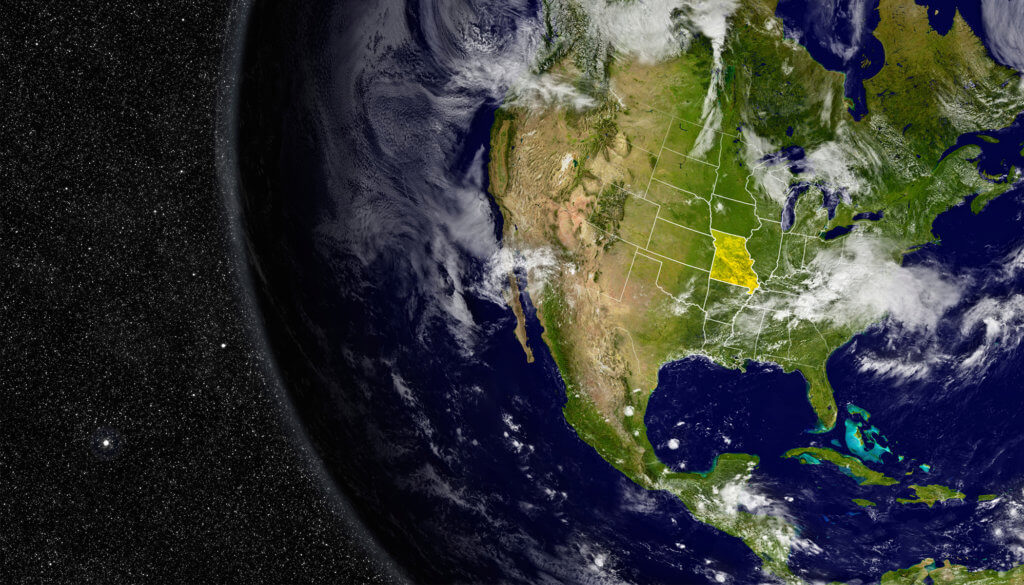

Missouri is bordered by eight states and is the statistical population center of the U.S., according to the 2020 U.S. Census. The central location of Missouri makes it simple to transport raw materials by rail, highway, water, or air.

Missouri has three foreign trade zones: the Greater Kansas City Foreign Trade Zone, the City of Springfield Foreign Trade Zone, and the St. Louis Country Port Authority – making Missouri the top Midwest state to welcome foreign companies.

Missouri’s 3.1 million-strong workforce and firm belief that workers should have access to training and upskilling opportunities is one of its main appeals to businesses. Companies such as Amazon and Meta, formerly Facebook, have recently invested in Missouri. With the advantages of low tax rates, a skilled workforce, and low business costs, Missouri is attracting the attention of foreign businesses in a variety of industries.

Read more about FDI in Missouri here.